Careful With Your Crypto!

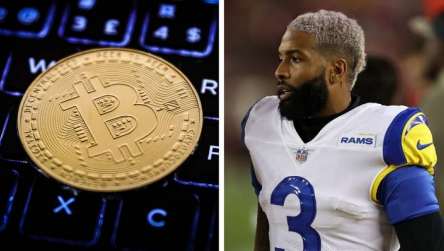

A few weeks ago, the Rams won a Super Bowl for the first time since they have called Los Angeles “Home”. One of their stars, Odell Beckham Jr. (“OBJ”), signed a one-year contract prior to this season to play wide receiver for the Rams. For better or for worse, OBJ decided to convert his base salary in Bitcoin which was a risky venture.

His story serves as a cautionary tale when it comes to accepting Bitcoin, (or any crypto currency) as salary or otherwise due the potential annual tax implications and the possible impact of that as a taxable asset within your estate plan.

Crypto – A Risk Worth Taking?

OBJ is not the only athlete, to receive/convert salary to Bitcoin (Saquon Barkley, Trevor Lawrence, and Russell Okung, among others, have done the same). NFL tackle Russell Okung was reportedly the first player to convert salary to Bitcoin in 2020. He stated that he converted $6.5 million of his $13 million into Bitcoin. If this was done immediately upon entering his contract with the Carolina Panthers, he would have received approximately 500 Bitcoin based on the prices at the time. Today, that Bitcoin is worth over $20 million. Seems like that was a lucky gamble on his part. There have been several others that have done the same, with mixed results.

In November of 2021, OBJ and the Rams agreed to a one-year deal. At the time, OBJ struck a deal with CashApp and agreed to convert his $750,000 base salary to Bitcoin. Many people, and especially those involved in the crypto world, applauded OBJ for converting salary to Bitcoin and it was viewed by some as evidence that a “global adoption” was on the way. In fact, the way cryptocurrency was moving along at the time, it seemed like an excellent gamble.

Crypto Is Uncertain. Death and Taxes Are Not.

Unfortunately, that gamble did not pay off. At the time OBJ converted the $750,000 base salary to Bitcoin it was worth $64,293 per Bitcoin. However, Bitcoin took a dive and, as of today, it is worth approximately $41,110. Around the time of the Super Bowl, there were articles written about his salary when Bitcoin was worth approximately $35,400 per Bitcoin. Those articles provided figures showing he was netting approximately $36,000 of his $750,000 base salary. Seems like he could make that much flipping burgers, and that’s a lot safer.

The main issue here is, despite the drop in Bitcoin value, OBJ would still have to pay taxes on income as provided to him at its $750,000 value. Based on the current values, the timeline and math work out as follows:

- On November 12, OBJ signed the deal with the Rams with base salary of $750,000, which he converted to Bitcoin.

- At the time the contract was entered into, Bitcoin was worth $64,293. Today it is worth approximately $41,110.

- Today, the deal is worth $479,761.

- But OBJ will be taxed on the $750,000 base salary contract. Federal and California state tax will likely be approximately 50%

- As of today, OBJ has netted $102,511 of his base salary of $750,000 from the Rams contract.

I bring this up to highlight that, regardless of what happens and regardless that Bitcoin has dropped dramatically in value, the IRS and the California Franchise Tax Board do not care. His taxes on the base salary will be based on the $750,000 in his contract, even if the drop in value was nearly immediate. The top tier percentage for federal income tax is 37% and California state tax is 12.3%.

Some of this is speculation because we do not really know if he converted the full $750,000 of base salary to Bitcoin all at once or spread out over time, which would change the numbers a bit. However, the same message and lesson applies regardless. What is certain is that OBJ would have been much better off taking his salary in regular U.S. dollars.

Fortunately for OBJ, it isn’t all bad news. Because the Rams won their division playoff game, the conference championship, and the Super Bowl®, OBJ received $3 million in bonuses (which we can only presume he took in U.S. dollars for his bonus checks).

Advice? Seek Advice of Experts.

This all brings me to my point – It is always wise to seek counsel from multiple, industry experts when making financial decisions. At Law Stein Anderson, when we create your estate plan, we work collaboratively with your CPA, financial advisor(s), and within our own team to allow you to make the best decision that may or may not have financial and tax consequences. There is a Proverb that says, “Where there is no counsel, the people fall; but in the multitude of counselors there is safety.” OBJ may or may not have sought counsel on whether this was a good idea but doing so is akin to betting it all on black. A huge risk.

We Look Forward to Serving You and Wish You the Best

We are here to provide you with legal guidance you can trust while placing safety and health as a priority. We are happy to meet in person or to accommodate other needs, including Facetime, SKYPE and ZOOM for virtual, face-to-face connections. Contact us directly to speak with someone who can help answer your questions.

T (949) 501-4800

Or send us a private email at the link below and we will respond promptly:

info@lsalawyers.com

Visit our website for more information and to review our partner and attorney bios:

www.lsalawyers.com

The Law Stein Anderson Newsletter is a monthly publication to share useful information with our clients in matters of estate planning, tax planning, inheritance dispute litigation, elder abuse, probate and business litigation, and premises and product liability defense.

Written by Nathan R. Loftin, Esq.

See this link for a printable version of our January 2022 newsletter >